Intelligent Insurance

Streamlining the user experience with a single destination customer portal

Boosting sales, increasing conversions and bringing much-needed efficiencies.

Boosting sales, increasing conversions and bringing much-needed efficiencies.

Intelligent Insurance is a specialist insurer, dedicated to finding home insurance for typically ‘hard to insure’ properties and circumstances. They pride themselves on arranging high-quality, competitively priced home insurance for everyone, whatever their property type, condition, usage or personal circumstances.

We’ve been working with Intelligent Insurance since late 2019. After making some changes to their renewal portal for existing customers, they approached us to help them with two specific challenges that would further improve their online customer experience.

The first challenge was to help improve their new customer journey. Intelligent Insurance has a linear “quote & buy” website which is developed, maintained and hosted by Open GI insurance software. In a single session this website allows a customer to create a new quote and purchase it. However, the nature of purchasing new insurance often involves comparison. Frequently customers will end their journey after receiving a quote to compare elsewhere and then return to their preferred supplier to buy. Although Intelligent Insurance has a login within its renewal portal, this didn’t provide a solution for quote holders. This resulted in a number of new customers having an inability to retrieve their quote to purchase a new policy, resulting in customer frustration and lost opportunity.

Although Intelligent insurance were working on making changes to their internal system to solve the issues, the update required a significant rebuild of the website, something that would have taken too long to implement due to the long lead times of some third party integrations. They needed a remedial solution that would improve the journey quickly and see a return within the first 12-18 months.

The second challenge surfaced during Covid-19 when many of the Intelligent Insurance customer service team were working from home. During this time they made the decision to move away from a traditional call centre support centre, to online web chat. However this made taking one off payments difficult whilst remaining PCI compliant. The functionality just doesn’t exist within the web chat system. Intelligent Insurance needed a way for their team to create personal payment requests, send these to their customers and allow customers to safely and securely pay online.

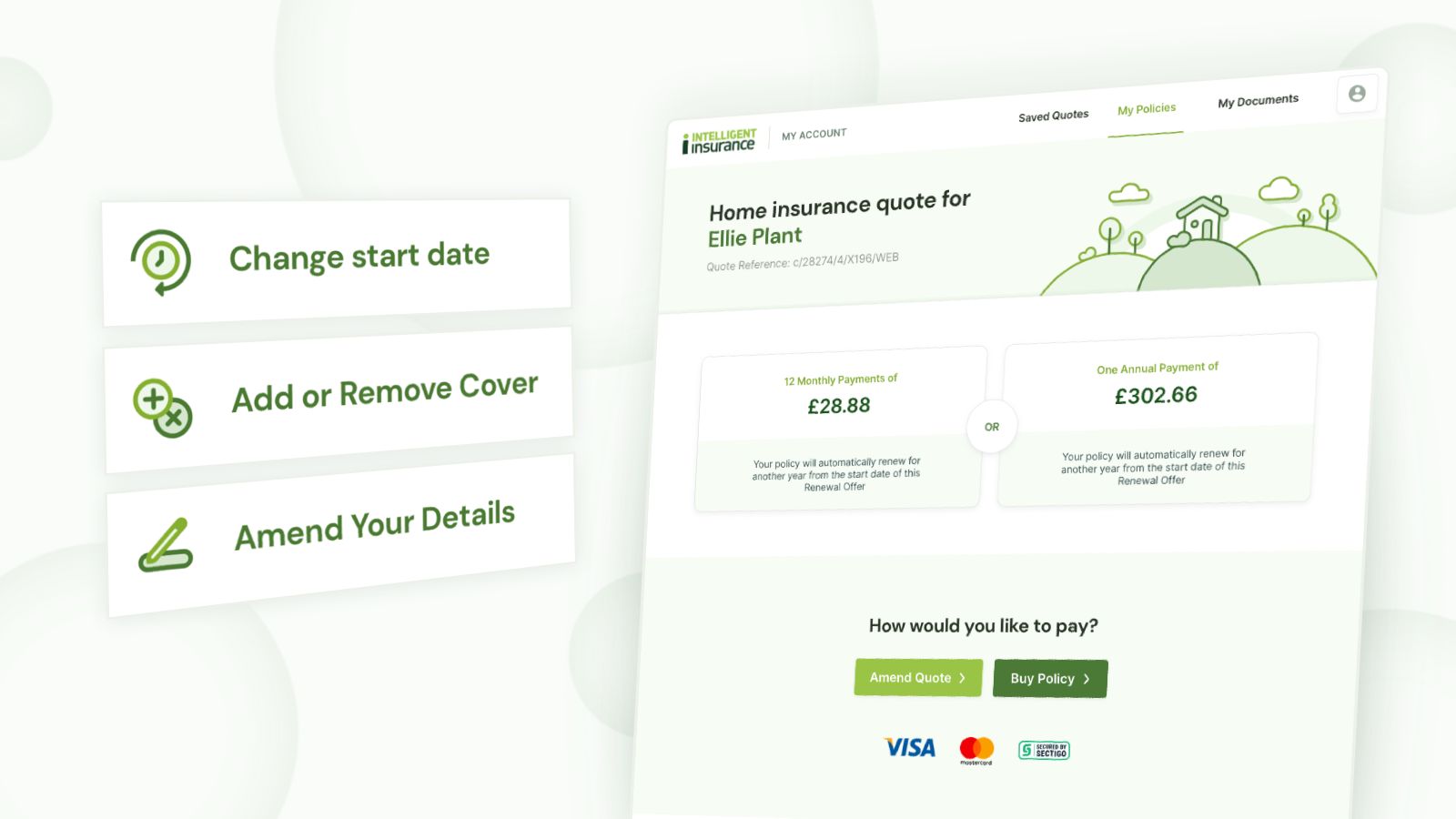

We created a Customer Portal that allows new customers to create an Intelligent Insurance account. Here they can view, update and amend; quotes, renewals, offers, promotions and click to buy. It provides a single destination for the customer on the front end, while all the heavy lifting is done in the background with four different integrations to ensure accurate data management.

Although all functionality isn’t within the one place, the portal provides deep links into the other systems. Automatically logging the customer in, and leading them directly to the right place to amend a quote, buy or renew a policy.

To access the customer portal, the customer creates an account using their email address, this sends an email to verify their email address. In the background the portal checks the Intelligent Insurance database to retrieve existing quotes or policies linked to that email address.

Then once logged in customers can:

We work with lots of suppliers, but working with Helen, Penny and the Rareloop team has been a breath of fresh air. They’ve challenged us to think differently. By fully understanding the challenge early on they were able to partner with us to architect and deliver the right solution.David Gissinger, Chief Information Officer - Intelligent Insurance

To create a seamless front end experience for the user whilst pulling information from multiple systems requires detailed thought and planning. Within the discovery phase we worked collaboratively with the Intelligent Insurance team to fully understand the current infrastructure and the limitations of each system to create the right solution.

The customer portal integrates with:

This provides a much better user experience, as with a single login they are able to access everything they need, even though they are interacting with four different systems.

For both solutions, we wanted to ensure that the user experience was simple and easy to use. Whilst the design left customers feeling safe and secure. We took inspiration from the banking sector to achieve this. We also developed a simple illustrated graphic to bring the brand to life and add creativity to what can often be a very transactional experience.

The payment portal allows the Intelligent Insurance team to take one-off payments from their customers for changes or updates to their policy. This solution is two-fold. As it provides a staff portal to create the one-off payment links, and a personalised easy to use front end for the customers to complete payments. All whilst updating the relevant systems in real-time.

The Intelligent Insurance team have direct access to the secure payment portal where they can:

To create a new payment link they add a few customer details:

On completion of the form the system checks the policy number against the policy administration system. This is to ensure it corresponds with a live quote or policy. If valid, the system generates a unique and secure link which can be copied and shared in the live chat, or emailed directly to the customer if they are on the phone.

Once the link is clicked, a customer is taken to a personalised Intelligent Insurance page.

This page confirms the payment amount and a description of what it is for. The customer completes a short form to add their cardholder information before being taken to a secure payment page (integrated with SagePay). On completion the transaction information is sent to the Payment Portal and the policy administration system is updated.

After the link is generated and sent to a customer, the admin team can view the status of the link in real time. The status tells them if the link is: Created, Visited, In Progress, payment successful, payment fail. Allowing them to respond to customers if they get in touch again.

Since the launch of the Customer Portal and Payment Portal, Intelligent Insurance has already seen improved customer perception, increased efficiencies and uplift in quote conversion.

Intelligent Insurance have seen a huge take up in their payment portal and seen huge efficiencies in the time it takes to receive payment.

Prior to having the ability to send a one-off payment link the customer support team would spend up to 3 days trying to call a customer to take payment. In the best case they’ve seen responses in less than 6 minutes, with faster payments producing a reduction in staff admin time.

The feedback has been positive from both staff and customers.

The payment link works well, and looks professional

Intelligent Insurance monitors the customer journey, and although there is still some drop off on immediate payment after receiving the link, there is very little friction once a customer clicks on the link, which is really positive.

This is just the beginning for Intelligent Insurance. We will continue to work with them to improve their customer journeys and experiences to support them in their digital transformation ambitions.

If you’d like to see how we can support your Digital Transformation journey please get in touch. We’d love to hear more.

I love being challenged, and the team at Rareloop have fostered a really constructive working relationship with us. We are so pleased with the Customer and Payment Portal. We have already seen process efficiencies and financial benefits. They’ve helped us develop a really well architecturally designed solution, proving that building something scalable doesn’t need to be complex.David Gissinger, Chief Information Officer - Intelligent Insurance

We help forward thinking organisations solve difficult problems. Get in touch and let us know how we can help.

Get in Contact